How to Explain Buydown to First-Time Buyers (Script Included)

January 30, 2026How to Explain Buydown to First-Time Buyers (Script Included)

Updated January 2026 | 8 min read | For Loan Officers

As a loan officer, you've probably experienced this: You mention "buydown" to a first-time buyer, and their eyes glaze over. They nod politely but clearly have no idea what you just said.

Here's the problem: Buydowns are simple, but we explain them in complicated ways. We throw around terms like "seller concessions," "note rate," and "temporary subsidy" that mean nothing to someone buying their first home.

In this guide, you'll get a proven script that explains buydowns in plain English, plus visual examples and answers to every objection you'll hear.

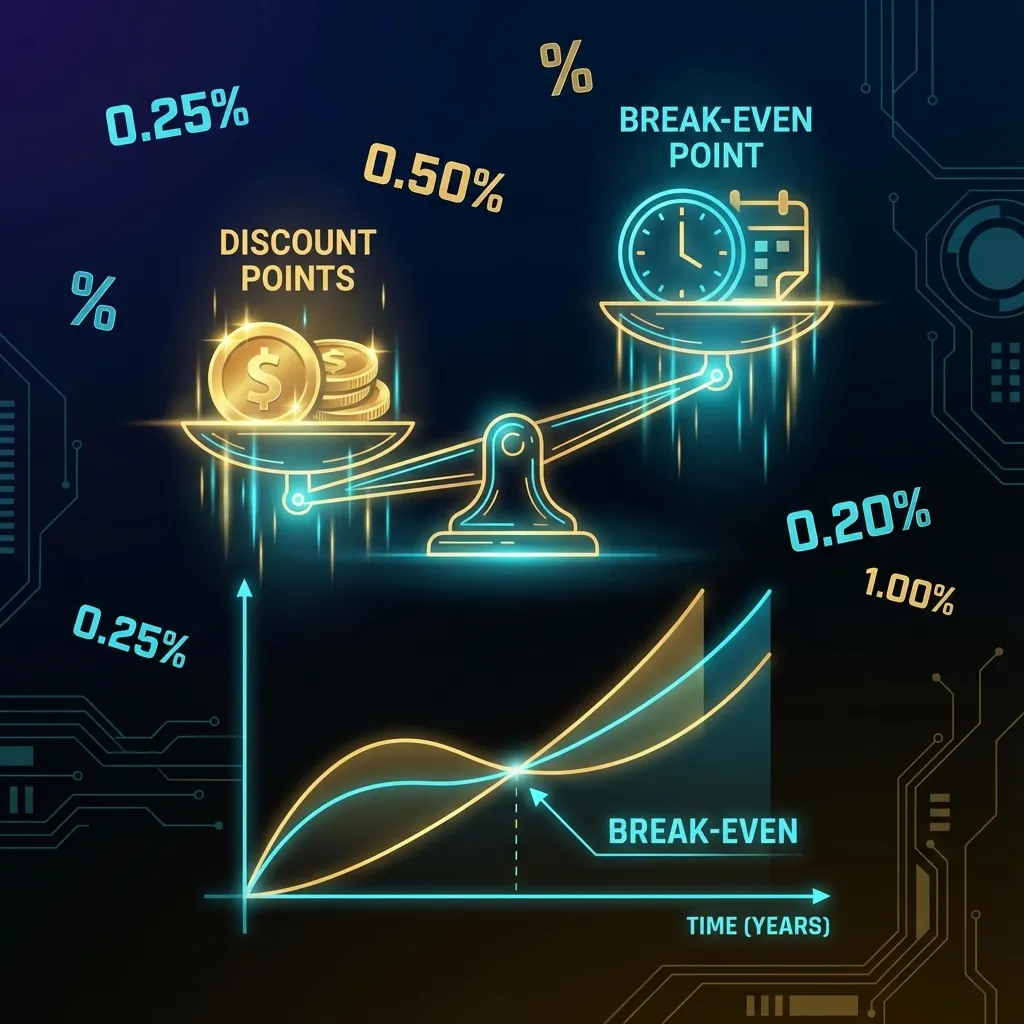

What is a Buydown? (Simple Definition)

A buydown is a discount on your monthly mortgage payment for the first 1-2 years, paid for by the seller or builder to help you afford the home.

That's it. Don't start with "temporary interest rate subsidy" or "seller-funded rate reduction." Start with the benefit: lower payments when you need them most.

Here's the analogy I use with first-time buyers:

"Think of it like a gym membership discount. The gym offers you 50% off for the first 2 months to get you started. The seller is doing the same thing with your mortgage - they're covering part of your interest for the first 1-2 years so you can afford the monthly payment while you're getting settled."

This clicks immediately because everyone understands promotional discounts.

Step-by-Step Explanation Script (Copy This)

Use this exact script when explaining a 2-1 buydown to first-time buyers. I've used variations of this hundreds of times with a 90%+ comprehension rate.

The 3-Minute Buydown Explanation Script

Opening (Set Expectations):

"Let me show you something that could save you about $500 per month for the first two years. It's called a 2-1 buydown, and the best part is the seller pays for it, not you. Sound good? Let me break it down in 3 simple points."

Point 1 - What It Is:

"A 2-1 buydown lowers your interest rate - and therefore your monthly payment - for the first two years of your loan. In Year 1, your rate is 2% lower. In Year 2, it's 1% lower. Then in Year 3 and beyond, it goes to the normal rate."

Point 2 - Real Numbers:

"Here's what this looks like with real numbers. Let's say the normal rate is 7% on a $400,000 loan. Without a buydown, your monthly payment is $2,661. With a 2-1 buydown:

- Year 1 (5% rate): You pay only $2,147/month - that's $514 less every month

- Year 2 (6% rate): You pay $2,398/month - still $263 less

- Year 3+ (7% rate): Back to the normal $2,661/month

That's over $6,000 in savings during your first year alone."

Point 3 - Who Pays:

"Now here's the key: You're not paying for this. The seller includes the buydown cost in the home price. It's similar to when you see 'dealer pays first 3 months' on a car lease. The seller is giving you this benefit to help you qualify and make the home more affordable right now."

Handling the Obvious Question:

"But what happens in Year 3 when my payment goes up?"

"Great question - everyone asks that. Three things usually happen by Year 3:

- Your income has likely increased (promotions, raises, dual income if married)

- If interest rates drop, you can refinance to a lower rate before Year 3

- You've built equity and have more financial flexibility

Plus, many first-time buyers end up refinancing within 2-3 years anyway when rates improve. The buydown helps you get into the home now while you're building your financial foundation."

Closing (CTA):

"Make sense? I can run the exact numbers for your specific situation. Would you like to see what your Year 1 payment would be with a buydown versus without?"

Visual Example: $400K Home Buydown Scenario

First-time buyers understand numbers better than concepts. Show them this side-by-side comparison:

| Timeline | With 2-1 Buydown | Without Buydown |

|---|---|---|

| Year 1 | $2,147/mo (5% rate) | $2,661/mo (7% rate) |

| Year 2 | $2,398/mo (6% rate) | $2,661/mo (7% rate) |

| Year 3-30 | $2,661/mo (7% rate) | $2,661/mo (7% rate) |

| Total Savings (2 yrs) | $9,324 | $0 |

| Your Cost | $0 (seller paid) | - |

Key talking point: "You save over $9,000 in the first two years, and it costs you zero dollars out of pocket because the seller pays for it."

Common Questions First-Time Buyers Ask

❓ "Is this some kind of trick or scam?"

Answer: "Not at all - it's a legitimate mortgage product that's been around for 40+ years. Fannie Mae, Freddie Mac, FHA, and VA all approve buydowns. Your lender is required to show all the details on your official Loan Estimate, so everything is transparent and documented."

❓ "Can I sell the house before Year 3?"

Answer: "Absolutely. There's no penalty for selling or refinancing during the buydown period. If you sell in Year 1, you simply stop receiving the buydown benefit - no money owed back to anyone."

❓ "Why would the seller pay for this?"

Answer: "Sellers use buydowns as a sales incentive, especially in buyer's markets or when interest rates are high. It helps them sell the home faster by making it more affordable for buyers. Builders especially use buydowns to move inventory. Think of it as a strategic discount - they'd rather lower your monthly payment than drop the home price."

❓ "What if I can't afford the Year 3 payment?"

Answer: "That's why we qualify you at the full Year 3 rate, not the buydown rate. If you can't qualify at the 7% rate, we won't approve the loan - even with the buydown. This protects you from buying a home you can't afford long-term. The buydown just gives you breathing room in Years 1-2."

❓ "Should I take the buydown or ask the seller for a price reduction instead?"

Answer: "Great question. Here's the math: A $17,000 buydown saves you about $9,000 over 2 years. If you negotiate a $17,000 price reduction instead, you save about $110/month over 30 years ($39,600 total). BUT - if you refinance within 3 years (which most buyers do), the buydown is often better because you get the savings upfront when cash is tightest. I can run both scenarios for you."

❓ "Is this the same as an ARM?"

Answer: "No. With an ARM (Adjustable Rate Mortgage), your rate can go up OR down based on market conditions - it's unpredictable. With a buydown, you know exactly what your rate will be each year: 5% Year 1, 6% Year 2, 7% Year 3+. It's a fixed-rate loan with a temporary discount, not an adjustable loan."

When to Recommend a Buydown (And When Not To)

✅ Recommend Buydowns When:

- The seller is paying for it - Free money is almost always a good deal

- The buyer expects income growth - New job, spouse returning to work, recent grad with upside

- Rates are high and likely to drop - Buyer plans to refinance in 1-3 years

- Buyer is on the edge of DTI limits - Lower Year 1 payment helps them qualify

- First-time buyer with tight budget - Reduced payments during furniture/moving costs period

❌ Don't Recommend Buydowns When:

- Buyer is paying for it themselves - Usually better to buy discount points for permanent savings

- Buyer can barely afford Year 3 payment - They're not truly qualified for the home

- Buyer plans to stay 10+ years without refinancing - 2-year savings are minimal over a decade

- Buyer has unstable income - Payment jump in Year 3 could cause problems

Summary: The 30-Second Buydown Pitch

If you only have 30 seconds to explain a buydown to a first-time buyer, say this:

"A 2-1 buydown lowers your monthly payment by about $500 in Year 1 and $250 in Year 2. The seller pays for it, so it costs you nothing. It helps you afford the home now while your income is growing. If rates drop, you can refinance. If not, your payment goes to the normal amount in Year 3 - which you're already qualified for. It's basically free money for two years."

Ready to Calculate?

Use our free 2-1 buydown calculator to show clients exactly what their monthly payments would be with and without a buydown. Takes 30 seconds.

Need help presenting the numbers? Try our AI closing script generator to create professional talking points automatically.

Related Articles:

💡 Ready to put this knowledge into action?

Try Our Free Calculators