News & Insights

Scripts, tutorials, and strategies to help loan officers close more deals

How AI-Generated Closing Scripts Help Loan Officers Close 30% More Deals

Complete guide to automated mortgage script creation: save 15-30 minutes per client, increase consistency, and close more deals with AI-powered talking points.

Read Article →More Articles

How to Explain Buydown to First-Time Buyers (Script Included)

Proven script for explaining 2-1 buydowns to first-time homebuyers. Includes copy-paste talking points, real examples, visual comparisons, and answers to common objections.

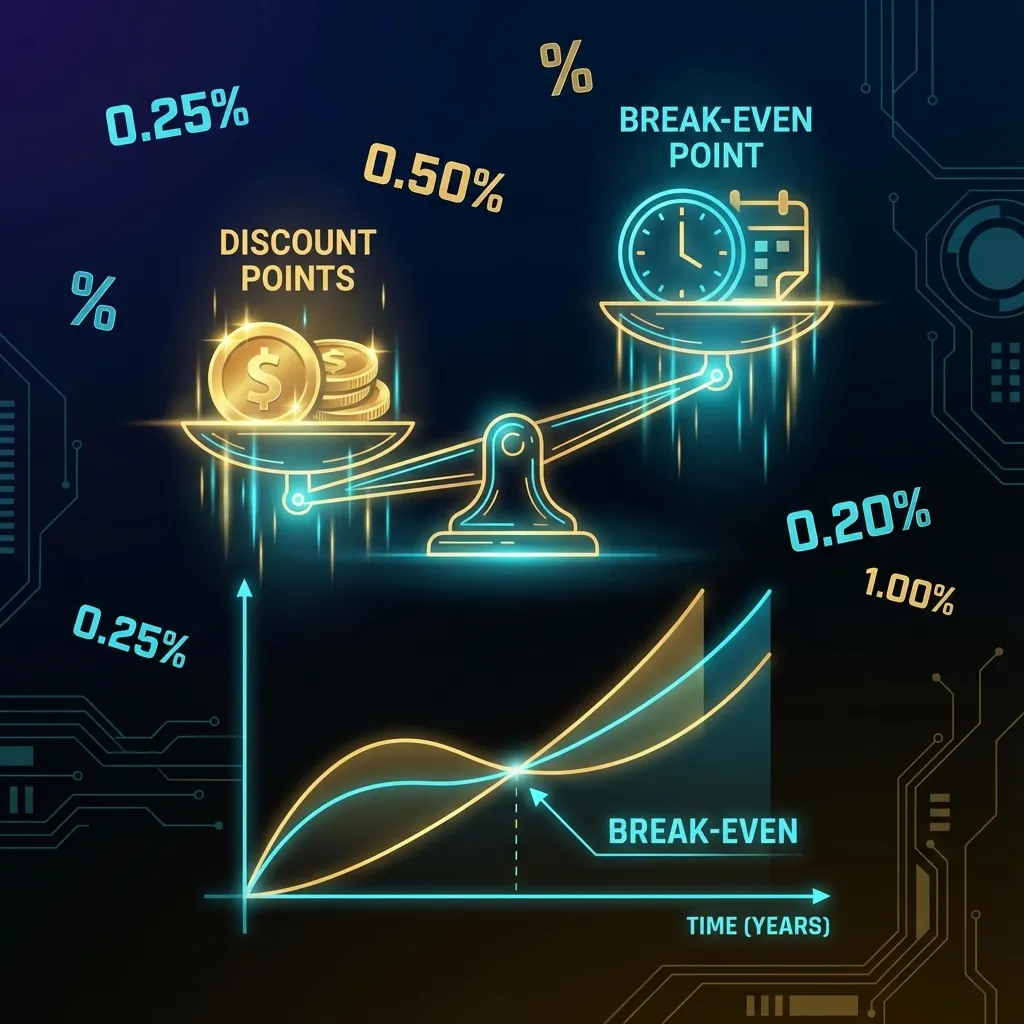

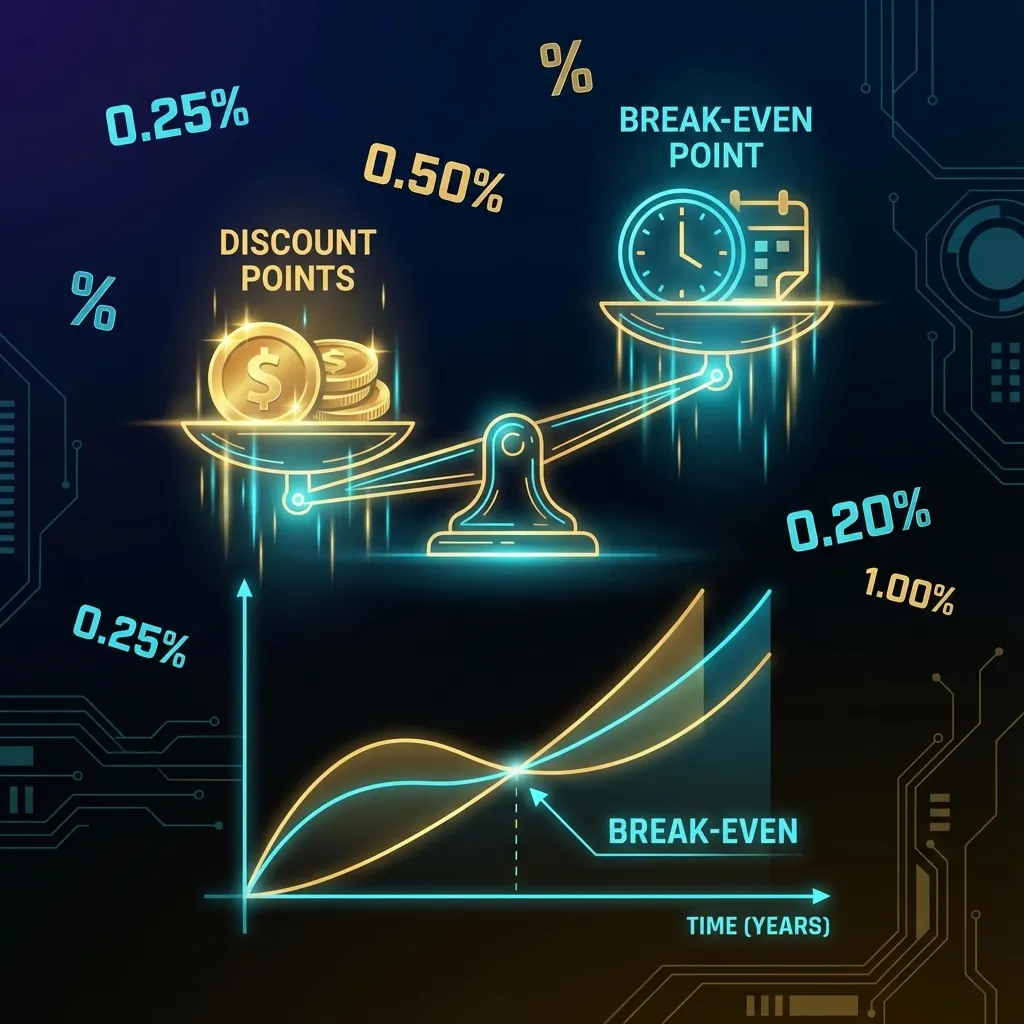

How Many Discount Points Can You Buy on a Mortgage?

Learn the limits on buying mortgage discount points. Understand how many points you can purchase, when it makes sense, and the diminishing returns.

What is a 2-1 Buydown? Complete Definition & Meaning

Understand exactly what a 2-1 buydown means. Clear definition, how it works, who pays, and when it makes sense for homebuyers.

2-1 Buydown Pros and Cons: Is It Right for You?

Comprehensive list of 2-1 buydown advantages and disadvantages. Make an informed decision with this complete pros and cons analysis.

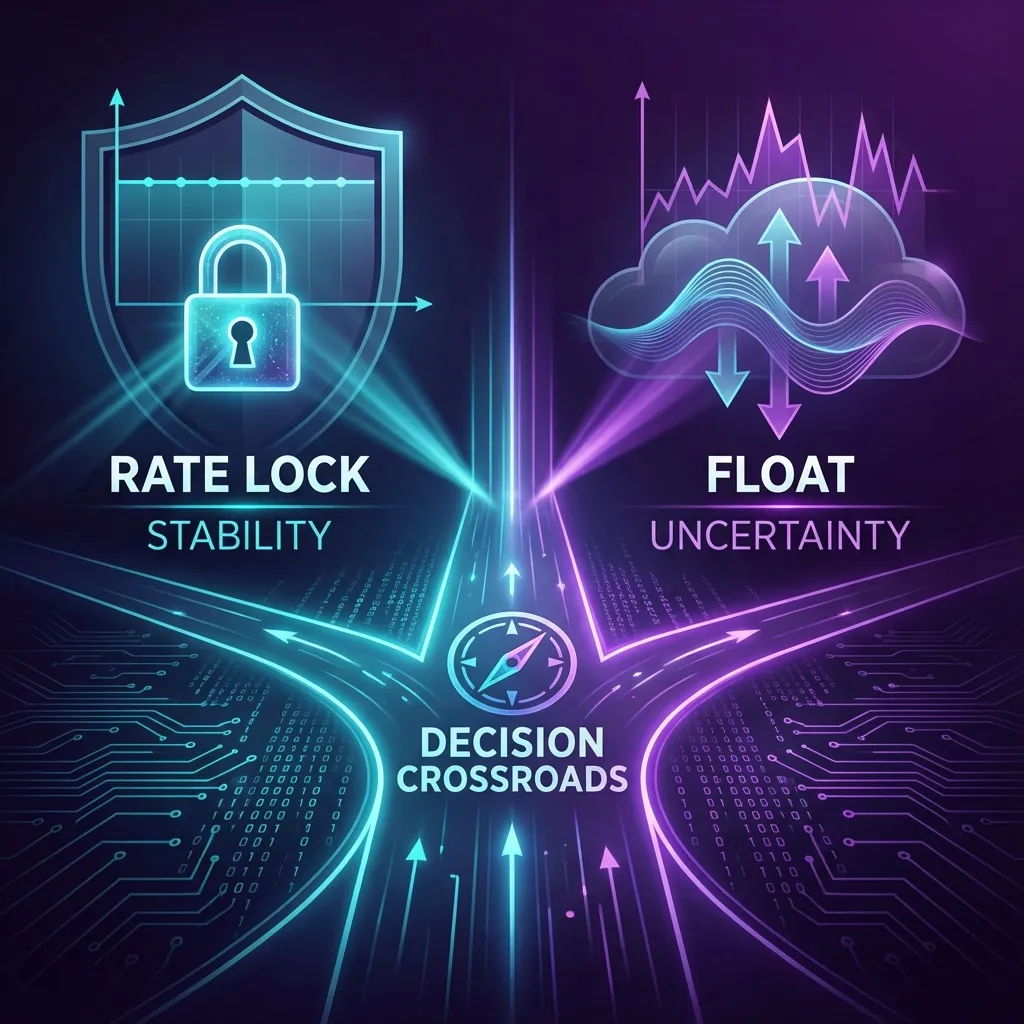

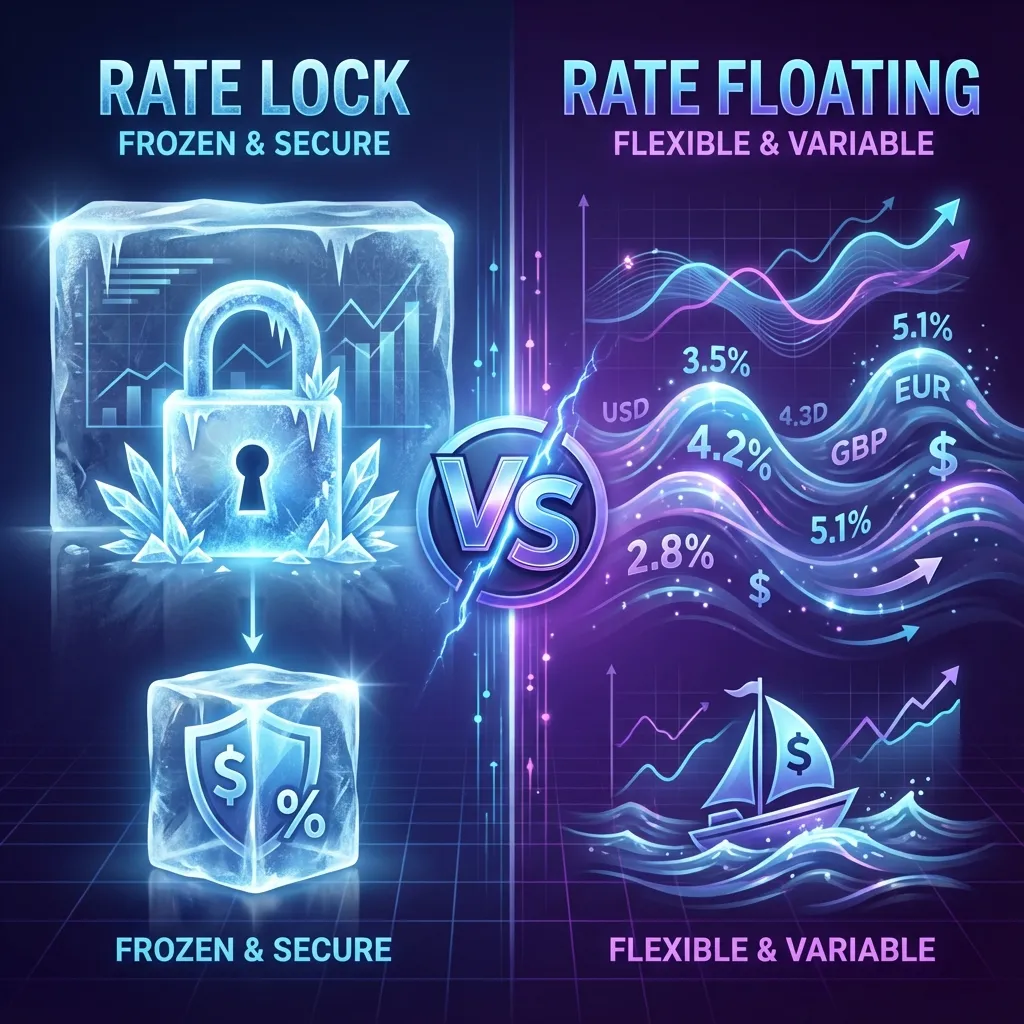

How to Explain Rate Lock vs Float to Borrowers

Help clients understand the lock vs. float decision. Scripts for explaining market risk, float-down options, and when each strategy makes sense.

How to Explain a 2-1 Buydown to Your Buyers (LO Script)

Master the art of explaining 2-1 buydowns to your clients. Copy-paste scripts, common objection handlers, and visual aids to close more deals.

2-1 Buydown Sales Script: Close More Deals in High-Rate Markets

Complete sales scripts for pitching 2-1 buydowns. Phone, in-person, and email templates designed for today's high-rate environment.

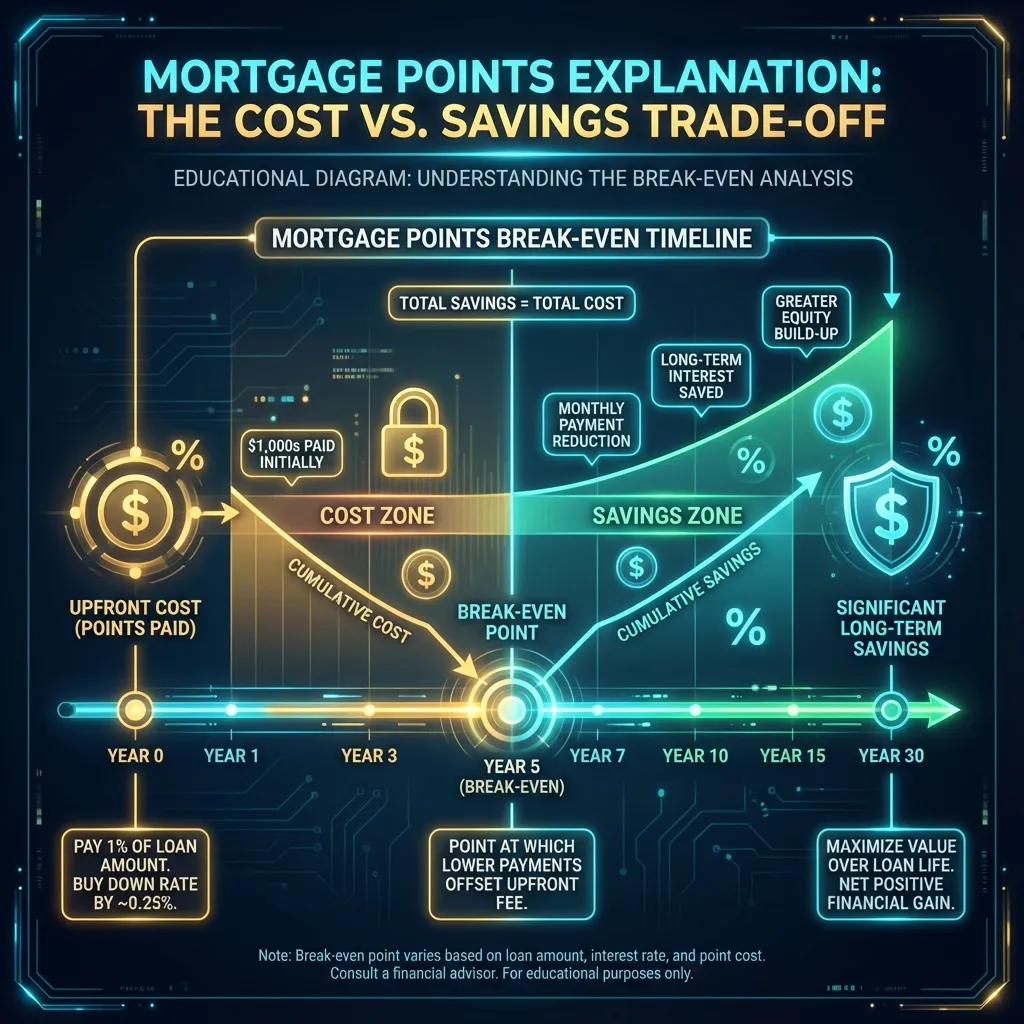

How to Explain Discount Points to Borrowers (LO Script)

Simple scripts to explain mortgage discount points to clients. Includes break-even visuals, decision frameworks, and objection handlers.

What is a 2-1 Buydown? Complete Guide for 2024

Learn how a 2-1 buydown can lower your mortgage payments for the first two years. Understand the costs, benefits, and when it makes sense.

How to Read Your Loan Estimate: Line by Line Guide

Demystify your loan estimate with this comprehensive guide. Understand every section and compare offers.

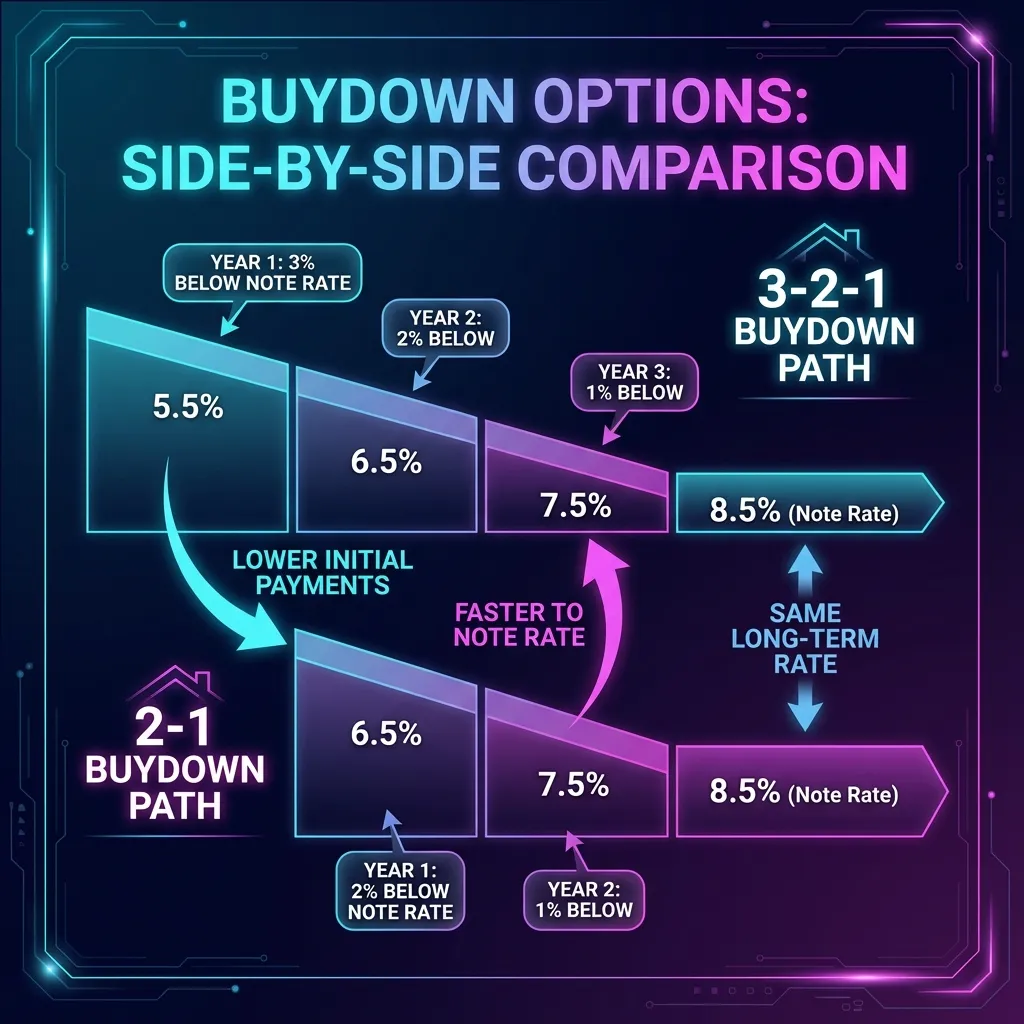

3-2-1 Buydown vs 2-1 Buydown: Which is Better?

Compare the two most popular temporary buydown options. Learn the cost differences and when each makes sense.

How Much Cash Do You Need to Close?

Calculate exactly how much money you need to bring to closing. Includes down payment, closing costs, credits, and reserves.

Seller Concessions Explained: How to Use Them Wisely

Learn how to maximize seller concessions for buydowns, closing costs, or rate reductions.

Should You Buy Mortgage Points? Break-Even Analysis

Discover when buying discount points makes financial sense. Learn the break-even formula and how to calculate if points are worth it for you.

Rate Lock vs Float: Making the Right Decision

Should you lock your mortgage rate now or wait? Understand the risks and rewards of each strategy to make an informed decision.

Complete Guide to Closing Costs: What to Expect

Everything you need to know about mortgage closing costs. Understand each fee, who pays what, and how to reduce your costs.

Market Update: Mortgage Rates in 2026

An in-depth look at the current state of mortgage rates and what to expect in the coming months.

Understanding Adjusted Rates

How do adjusted rates work and are they right for you? We break it down.

Ready to Try Our Tools?

Put these insights into action with our free mortgage calculators