How to Explain a 2-1 Buydown to Your Buyers (LO Script)

January 6, 2026How to Explain a 2-1 Buydown to Your Buyers

As a Loan Officer, you know the power of a 2-1 buydown—but can you explain it in 30 seconds flat? Here's your complete script toolkit.

The 30-Second Elevator Pitch

"A 2-1 buydown is like getting a discount on your interest rate for the first two years. The rate is 2% lower in year one, 1% lower in year two, then goes to your normal rate. The best part? The seller or builder usually pays for it—so you get lower payments without paying extra."

Step-by-Step Explanation Script

Opening the Conversation

"Let me show you something that could save you hundreds each month for the next two years..."

The Numbers Talk

Use a real example your client can relate to:

| Year | Rate | Monthly Payment | Monthly Savings |

|---|---|---|---|

| Year 1 | 5.0% | $2,147 | $514 |

| Year 2 | 6.0% | $2,398 | $263 |

| Year 3+ | 7.0% | $2,661 | $0 |

"On a $400,000 loan, you'd save over $9,000 in the first two years. That's real money in your pocket."

Addressing the "What Happens After?" Question

"Great question! After two years, your payment goes to the full rate. But here's the thing—if rates drop, you can refinance. If your income grows, the payment is more affordable. Either way, you've had two years of breathing room."

Handling Common Objections

"That sounds too good to be true."

"I get it. But here's how it works: the seller puts money in escrow upfront to cover the difference. It's not magic—it's just smart use of seller concessions."

"Why would the seller pay for this?"

"Because it helps them sell faster. Instead of dropping the price $10,000, they can offer a buydown that gives you $9,000 in savings AND helps you qualify more easily."

"What if I want to sell in 3 years?"

"Even better! You've enjoyed lower payments for 2 of those 3 years. The buydown cost you nothing—it came from the seller."

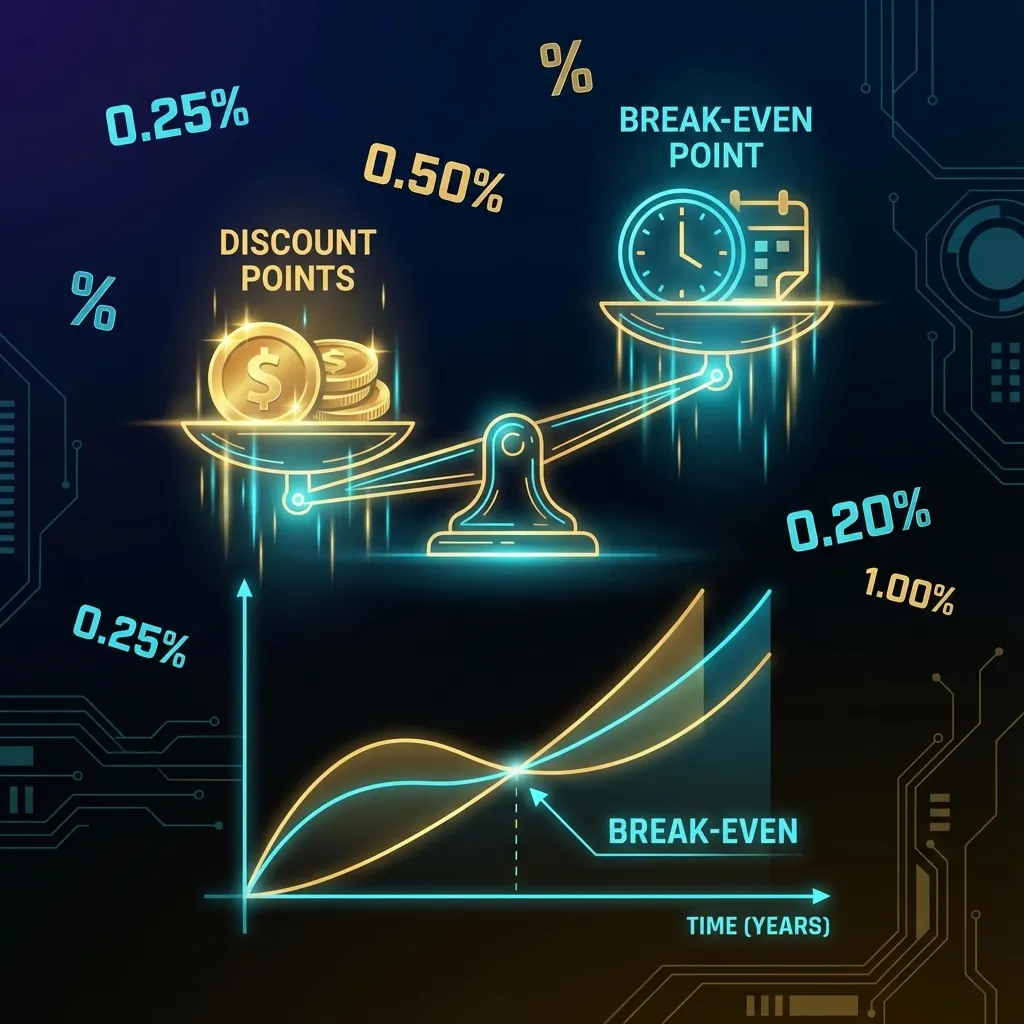

Visual Aid: Draw This for Your Client

Payment Timeline

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Year 1: ████████░░░░░░░░ $2,147 (Save $514/mo)

Year 2: ██████████████░░ $2,398 (Save $263/mo)

Year 3+: ████████████████ $2,661 (Full payment)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Closing the Conversation

"Here's what I recommend: let me run your numbers through our 2-1 Buydown Calculator so we can see exactly what this looks like for your situation. Then you can decide if it makes sense."

Ready to Create a Professional Buydown Comparison?

Use ShowTheRate to generate a beautiful, client-ready 2-1 buydown comparison in 60 seconds.

💡 Ready to put this knowledge into action?

Try Our Free Calculators