2-1 Buydown Pros and Cons: Is It Right for You?

January 6, 20262-1 Buydown Pros and Cons

Thinking about a 2-1 buydown? Here's an honest look at the advantages and disadvantages.

✅ Pros of a 2-1 Buydown

1. Lower Initial Payments

Your payments are significantly reduced for the first two years:

- Year 1: ~$500/month savings

- Year 2: ~$250/month savings

2. Easier Qualification

Some lenders qualify you at the Year 1 rate, making it easier to afford more home.

3. Cash Flow Flexibility

Extra monthly cash in years 1-2 can go toward:

- Building emergency fund

- Home improvements

- Paying down other debt

4. Usually Seller/Builder Paid

In most cases, you don't pay for it - the seller or builder does as a concession.

5. Refinance Opportunity

If rates drop significantly in 2-3 years, you can refinance and never pay the full rate.

6. Income Growth Alignment

Perfect if you expect raises or promotions that will cover the higher payment later.

❌ Cons of a 2-1 Buydown

1. Payment Shock in Year 3

Your payment jumps significantly when the buydown ends. Example:

- Year 2: $2,398/month

- Year 3: $2,661/month (+$263 increase)

2. Doesn't Reduce Total Interest

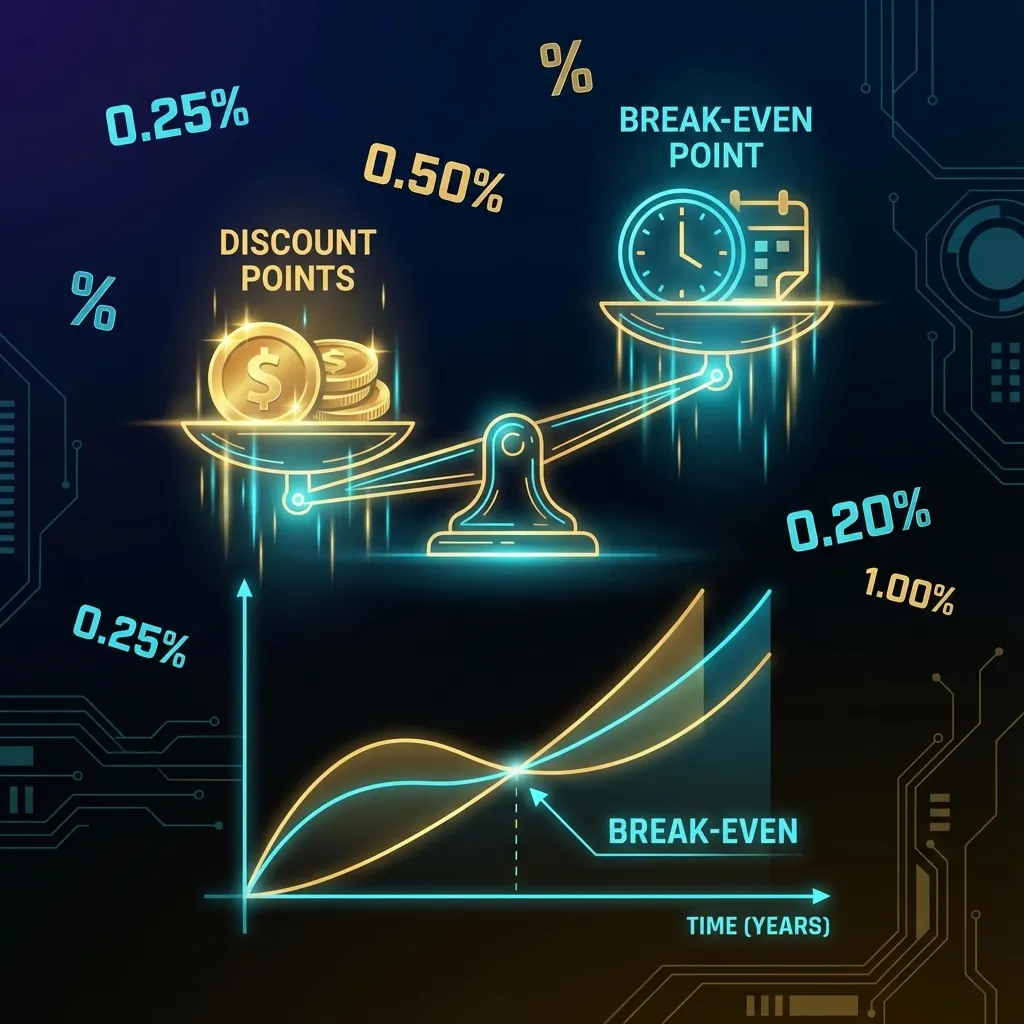

Unlike discount points, a buydown doesn't lower your long-term costs - you still pay the full rate eventually.

3. Opportunity Cost

That $9,000+ buydown cost could have been:

- A price reduction

- Closing cost credits

- Rate buy-down with points

4. Refinance Risk

If rates don't drop (or rise), you're stuck paying the full rate without an easy exit.

5. Qualification Confusion

Some lenders qualify at Year 3 rate anyway, eliminating one key benefit.

Quick Decision Matrix

| Situation | Recommendation |

|---|---|

| Seller offering concessions | ✅ Consider buydown |

| Expecting income growth | ✅ Good fit |

| Planning to refinance in 2-3 years | ✅ Good fit |

| Need lowest possible long-term rate | ❌ Choose points instead |

| Unsure you can afford Year 3 payment | ❌ Risky |

| Paying for it yourself | ⚠️ Calculate ROI carefully |

Calculate Your Specific Situation

Use our 2-1 Buydown Calculator to see exact numbers for your loan.

Or compare options with Is a 2-1 Buydown Worth It?

Ready to show a client the pros and cons visually? Create a comparison with ShowTheRate in 60 seconds.

💡 Ready to put this knowledge into action?

Try Our Free Calculators