buydowncomparison3-2-12-1

3-2-1 Buydown vs 2-1 Buydown: Which is Better?

January 5, 20263-2-1 Buydown vs 2-1 Buydown

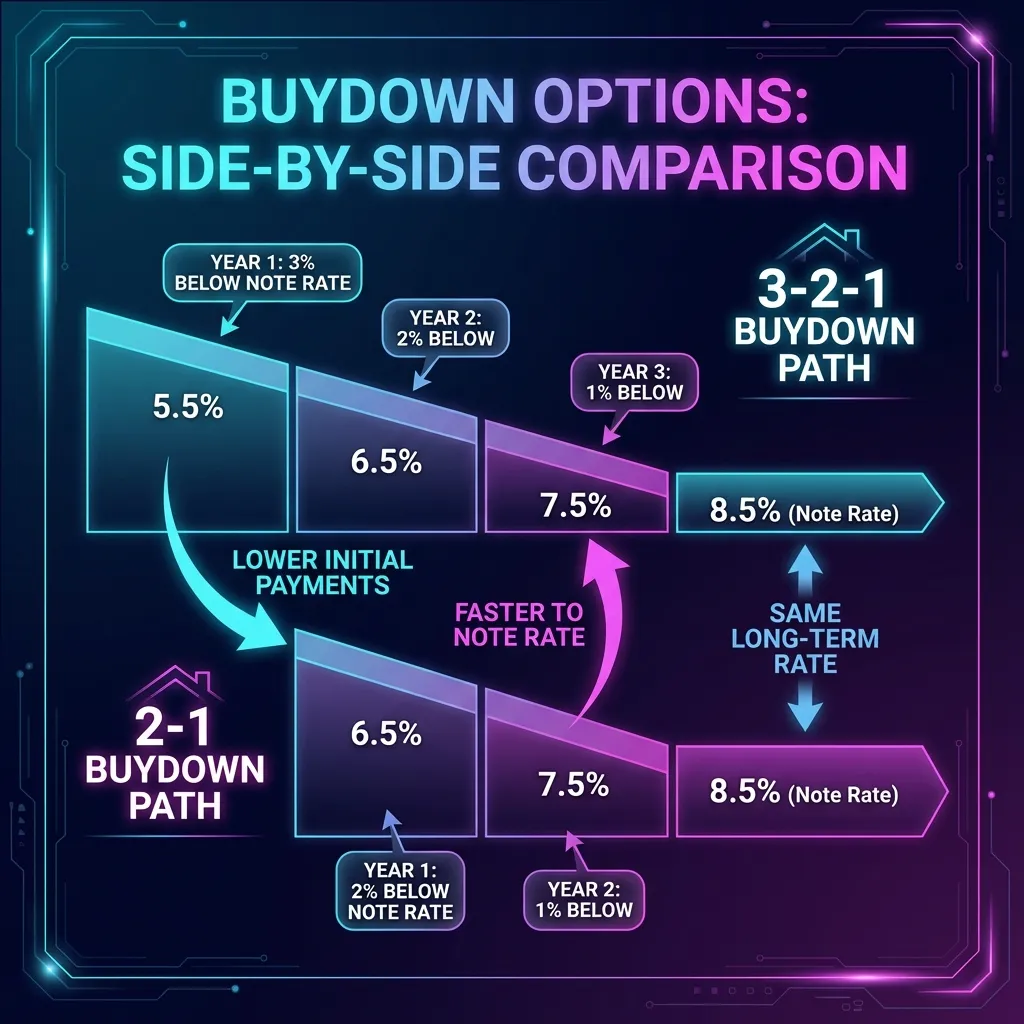

Both buydown types reduce your initial mortgage payments, but they work differently.

How They Compare

2-1 Buydown

- Year 1: Rate is 2% lower

- Year 2: Rate is 1% lower

- Year 3+: Full rate

3-2-1 Buydown

- Year 1: Rate is 3% lower

- Year 2: Rate is 2% lower

- Year 3: Rate is 1% lower

- Year 4+: Full rate

Cost Comparison

On a $400,000 loan at 7%:

| Buydown | Total Cost | Year 1 Savings |

|---|---|---|

| 2-1 | ~$9,300 | ~$514/month |

| 3-2-1 | ~$17,500 | ~$763/month |

When to Choose Each

Choose 2-1 Buydown When:

- Seller concessions are limited

- You expect to refinance within 2 years

Choose 3-2-1 Buydown When:

- Maximum first-year savings is priority

- You have more concession dollars available

Calculate Both Options

💡 Ready to put this knowledge into action?

Try Our Free Calculators