How to Explain Discount Points to Borrowers (LO Script)

January 6, 2026How to Explain Discount Points to Borrowers

Discount points can be confusing for clients. Here's how to explain them simply—and help clients decide if they're worth it.

The Simple Explanation Script

"Think of discount points like prepaying interest. You pay a little extra upfront to lock in a lower rate for the life of your loan. One point costs 1% of your loan and usually drops your rate by 0.25%."

The "Should I Buy Points?" Conversation

Opening Question

"How long do you plan to stay in this home?"

Decision Tree Script

If they say 2-3 years: "In that case, I'd probably skip the points. You won't be in the loan long enough to recoup the upfront cost."

If they say 5+ years: "Points could make a lot of sense for you. Let me show you the math..."

If they're unsure: "Let's calculate the break-even point so you can make an informed decision."

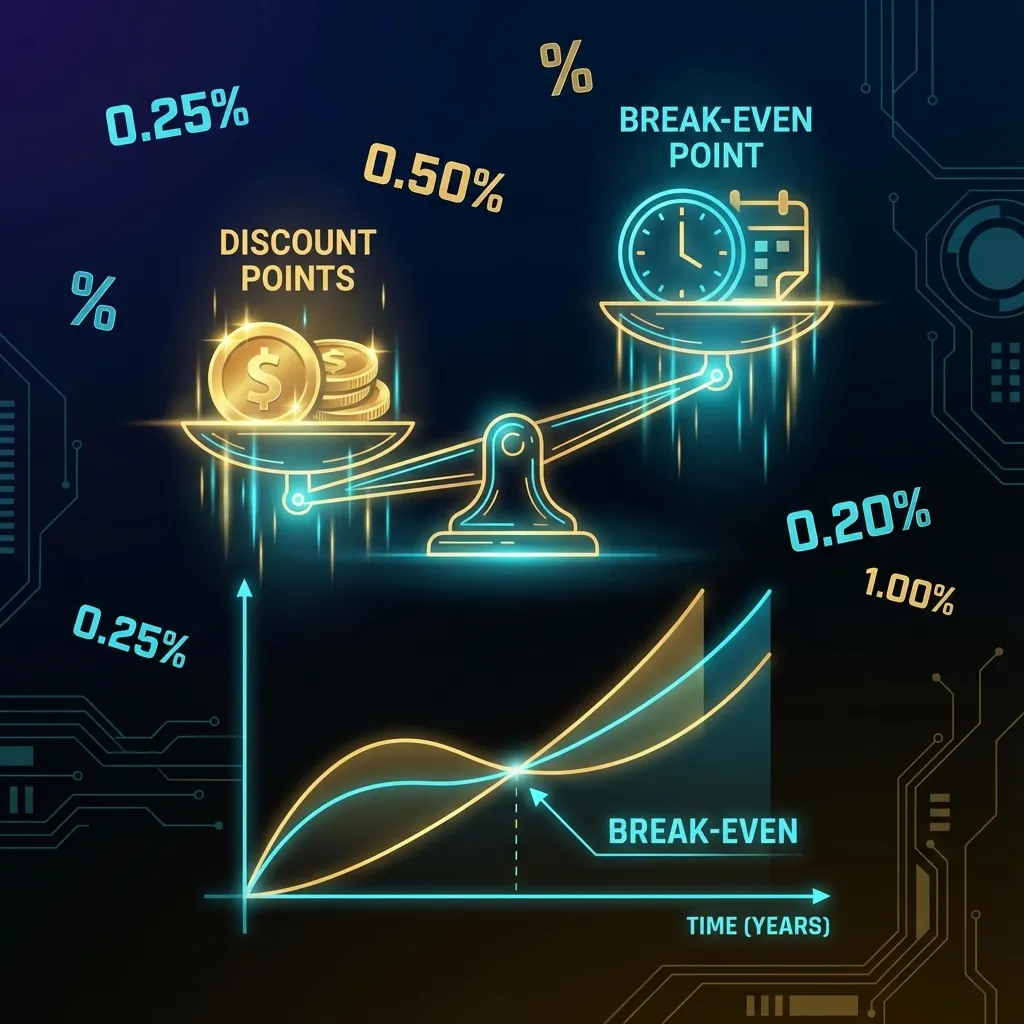

The Break-Even Explanation

Visual Aid

BREAK-EVEN TIMELINE

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Month 1-61: ████████████████░░░░░░░ Recovering cost

Month 62+: ░░░░░░░░░░░░░░░░████████ Pure savings!

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

↑ Break-Even Point (5.2 years)

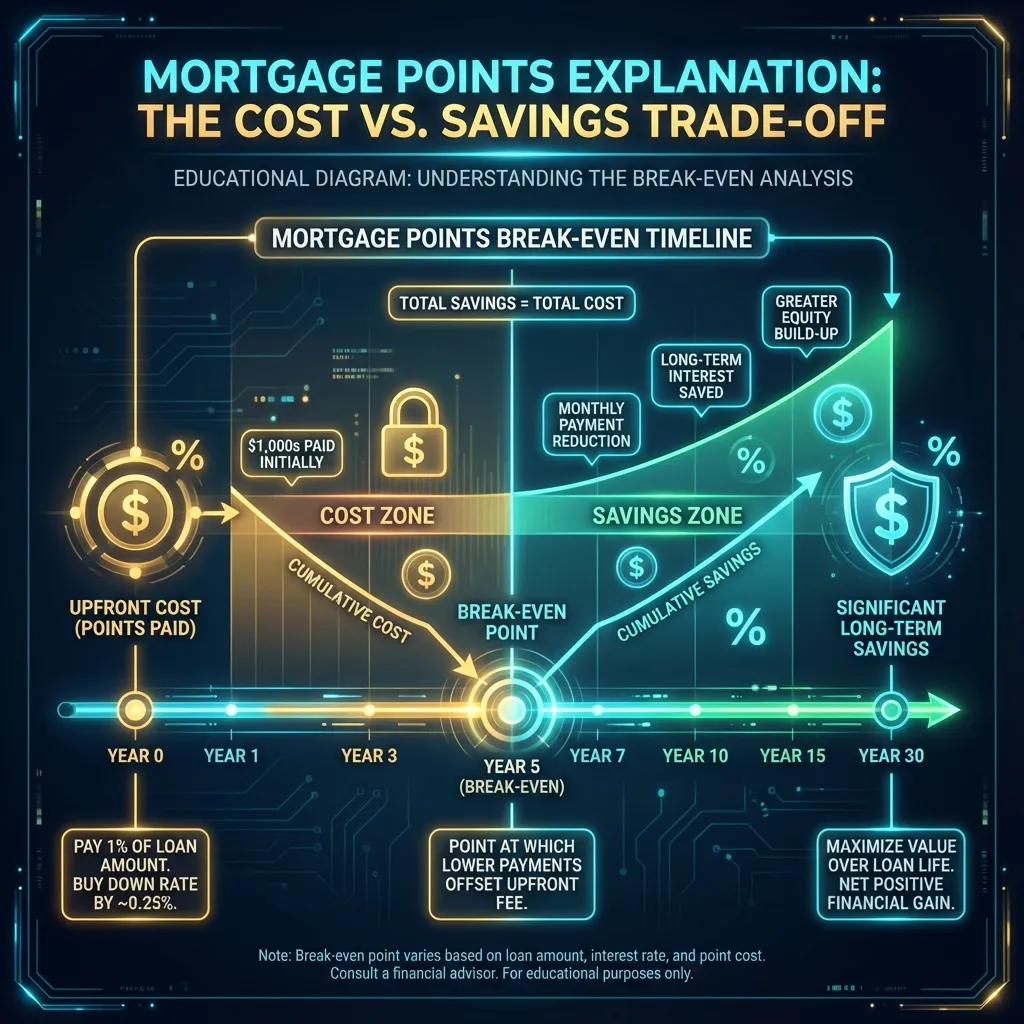

The Math Script

"Here's how it works. On your $400,000 loan:

- 1 point costs $4,000

- It saves you $65/month

- $4,000 ÷ $65 = 62 months to break even

So if you keep this loan for more than 5 years, you come out ahead. Every month after that is pure savings."

Quick Reference: Points Decision Matrix

| Situation | Recommendation | Why |

|---|---|---|

| Staying 7+ years | ✅ Buy points | Plenty of time to profit |

| Staying 3-5 years | ⚖️ Calculate carefully | Might break even |

| Staying <3 years | ❌ Skip points | Won't recoup cost |

| Cash-strapped | ❌ Skip points | Need funds elsewhere |

| Extra closing cash | ✅ Consider points | Good use of cash |

Handling Common Objections

"That's a lot of money upfront."

"I hear you. Let's look at it this way: you're essentially buying a guaranteed return. Over 10 years, that $4,000 becomes $7,800 in savings. That's almost a 100% return, tax-free."

"What if I refinance?"

"Great point. If rates drop significantly and you refinance in 3 years, you might not break even. But if rates stay flat or rise, you've locked in a great deal."

"My friend said never buy points."

"That might have been the right advice for their situation. But everyone's timeline is different. Let's look at YOUR numbers."

Points vs. No Points Comparison

$400,000 Loan, 30-Year Fixed

| Option | Rate | Monthly Payment | Cost | 10-Year Total |

|---|---|---|---|---|

| No Points | 7.00% | $2,661 | $0 | $319,320 |

| 1 Point | 6.75% | $2,596 | $4,000 | $311,520 + $4,000 |

| Difference | -$65/mo | +$4,000 | Save $3,800 |

Closing the Points Conversation

"Here's my recommendation: Let's run your specific numbers through our Points Break-Even Calculator. Then you'll know exactly how long until you're in the green."

Create a Points Comparison for Your Client

Use ShowTheRate to generate a professional side-by-side comparison showing points vs. no points scenarios.

💡 Ready to put this knowledge into action?

Try Our Free Calculators