rate-lockstrategymortgagedecision

Rate Lock vs Float: Making the Right Decision

January 5, 2026Rate Lock vs Float: Making the Right Decision

One of the most critical decisions during your mortgage process is whether to lock your rate or float.

What is a Rate Lock?

A rate lock guarantees your interest rate for a specific period (typically 30-60 days). If rates go up, you're protected. If rates drop, you're usually stuck.

What is Floating?

Floating means you don't lock your rate, betting that rates will drop before closing.

Factors to Consider

Lock Your Rate When:

- You're comfortable with the current rate

- Market volatility is high

- You can close within the lock period

Consider Floating When:

- Economic indicators suggest rates will drop

- You have flexibility on closing timing

- You have a float-down option

Float-Down Options

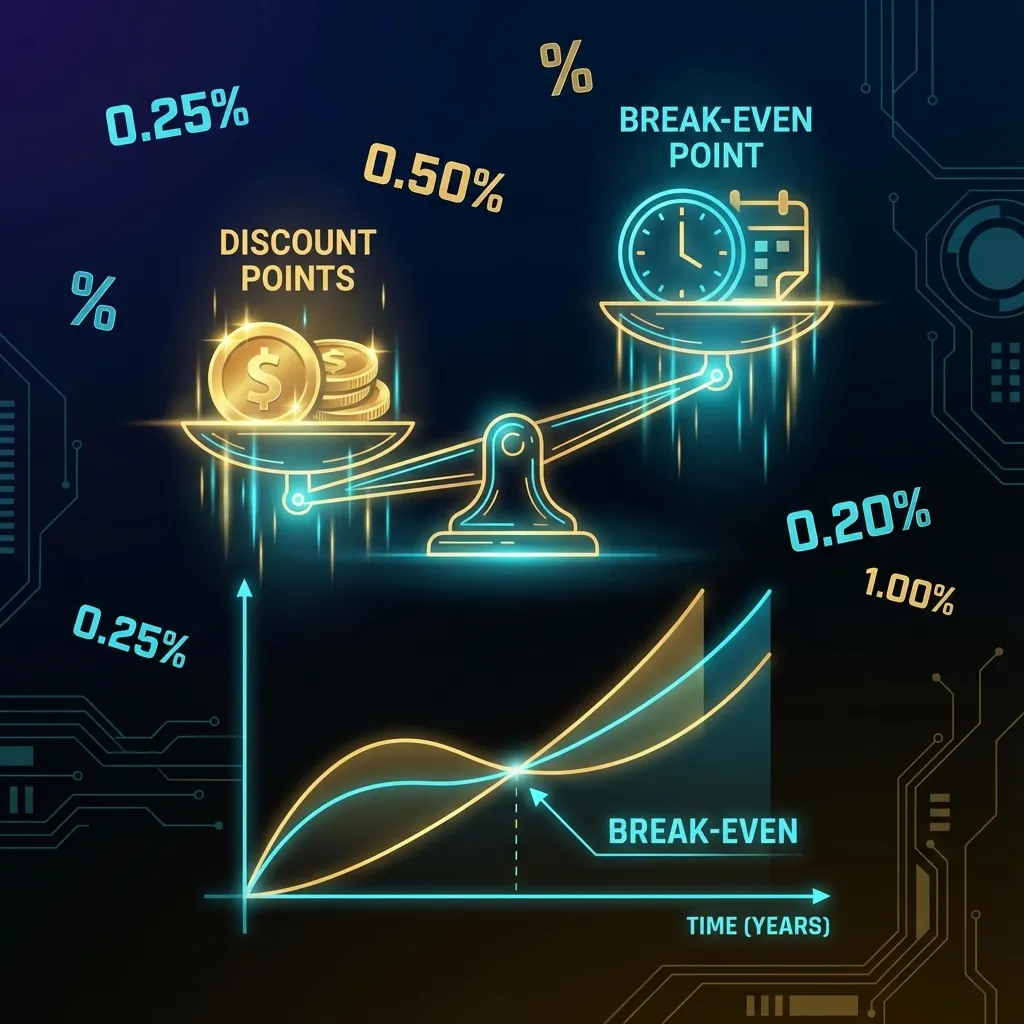

Some lenders offer float-down provisions. Use our Float Down Calculator to see if it's worth the cost.

💡 Ready to put this knowledge into action?

Try Our Free Calculators