pointsmortgagesavingsanalysis

Should You Buy Mortgage Points? Break-Even Analysis

January 5, 2026Should You Buy Mortgage Points?

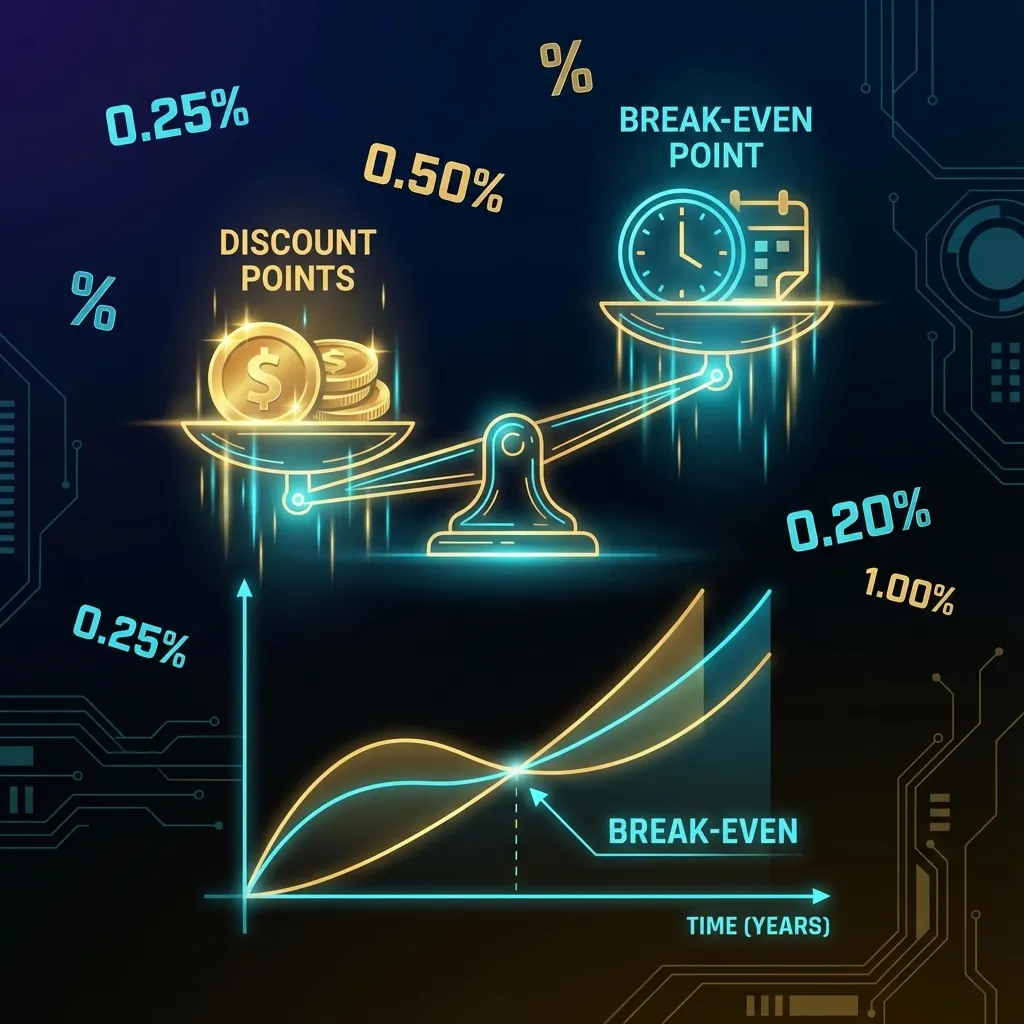

Discount points are upfront fees paid to the lender to reduce your interest rate. One point costs 1% of your loan amount and typically reduces your rate by 0.25%.

The Break-Even Formula

To determine if points are worth it:

Break-Even Months = Points Cost / Monthly Savings

Example:

- Loan Amount: $400,000

- Points Cost: $4,000 (1 point)

- Monthly Savings: $65

- Break-Even: 62 months (5.2 years)

When to Buy Points

Buy points if:

- You'll keep the loan past the break-even point

- You have extra cash at closing

- You want predictable long-term savings

Skip points if:

- You might sell or refinance soon

- You're short on closing funds

- Break-even is longer than your expected tenure

Calculate Your Break-Even

Use our Points Break-Even Calculator to see exactly how long until your points pay off.

💡 Ready to put this knowledge into action?

Try Our Free Calculators